Germany Intralogistics Market by Component (Hardware, Software and Services), and by End Users (Logistics, Food and Beverages, Retail and E-commerce, Automotive, Chemicals, Pharmaceuticals, Airport and Mining) – Opportunity Analysis and Industry Forecast, 2024–2030

Industry: Construction & Manufacturing | Publish Date: 28-Feb-2025 | No of Pages: 102 | No. of Tables: 71 | No. of Figures: 41 | Format: PDF | Report Code : CM1044

US Tariff Impact on Germany Intralogistics Market

Trump Tariffs Are Reshaping Global Business

Germany Intralogistics Market Overview

The Germany Intralogistics Market size was valued at USD 4.51 billion in 2024 and is predicted to reach USD 8.22 billion by 2030, registering a CAGR of 10.5% from 2025 to 2030.

The Germany intralogistics market is growing at a high speed due to expansion of e-commerce industry. Moreover, increasing focus on chemical and pharmaceutical sectors along with rise in initiatives by key market players boost the market growth. However, high installation cost restrains the market growth. Netherless, incorporation of artificial intelligence and internet of things in intralogistics system creates future growth opportunity for the market.

Surging Expansion of E-commerce Industry Boosts the Intralogistics Market in the Region

The rapid growth of ecommerce industry boosts the market due to the heightened demand for efficient warehousing, order processing, and distribution solutions. The upsurge in online shopping led to a rise in order volumes, requiring logistics providers to adopt advanced technologies.

The International Trade Administration report reveals that penetration of e-commerce in the German market for the year 2022 was 80%, ranking third globally, and the total sales figures achieved USD 141.20 billion with an improvement of 11% from 2021. This includes faster shipping, inventory accuracy, and optimized warehouse management, driving the need for innovative intralogistics solutions to handle the complexity and scale of e-commerce operations.

Growing Chemical and Pharmaceutical Sectors are in Turn Boosting Demand for Efficient Intralogistics Solutions

The growing emphasis on chemical and pharmaceutical sectors in Germany propels the demand for sensitive and high-value materials, which require careful management to ensure safe handling, storage, and transportation with minimal risk.

As these industries grow, their demand for specialized intralogistics solutions, such as automated systems for hazardous material handling, temperature-sensitive storage, and efficient transport mechanisms, escalates.

These systems ensure safety and operation efficiency in maintaining these large volumes of chemicals. As per the European Chemical Industry Council, the chemicals and pharmaceuticals sector are the third-largest industry with a turnover of USD 239.41 billion in 2023, which in turn boost the Germany intralogistics market growth.

Rising Initiates by Key Market Player Further Propels the Market Growth in the Country

The presence of key players such as Jungheinrich AG, Kion Group, and others propels the Germany intralogistics market expansion due to their strategic focus on business expansion through innovative initiatives including product launches and partnerships.

These companies enhance the efficiency and automation of intralogistics processes, meeting the growing demand for streamlined warehouse operations in sectors such as automotive, and manufacturing. For instance, in July 2023, Jungheinrich AG launched a mobile robot solution, the EAE 212a, designed specifically for low-level applications in warehouse environments, reflecting advancements in the German intralogistics industry.

Moreover, in October 2024, Kion Group partnered with Eurofork to enhance Kion's product offerings in the realm of automated solutions. These strategic initiatives by companies drives Germany's intralogistics sector, to meet the growing demand for automation across various industries.

High Installation Cost of Intralogistics Systems Restrains the Market Growth in the Country

The high installation cost of intralogistics systems hinders the market growth due to the significant upfront investment required for installing advanced automation technologies. The expense of purchasing and integrating systems including robotics and automated conveyors is prohibitive to small and medium-sized enterprises.

Moreover, maintenance, upgrading, and training the staff raises the cost. This makes the business avoid the use of advanced intralogistics solutions that would help in streamlining the operations and achieve maximum efficiency.

Incorporation of AI and Internet of Things (IoT) in Intralogistics System Presents Future Growth Opportunity for the Market

The integration of AI and IoT into intralogistics systems creates significant opportunities for the Germany intralogistics market demand. With the optimization of warehouse management, predictive maintenance, and supply chain logistics, the potential of AI and IoT offers smooth connectivity and data transfer between devices and systems. With the need for automation and efficiency, it is anticipated that companies will adopt AI and IoT in intralogistics systems to stay competitive in the market.

By Component, Hardware Holds the Dominant Share in Germany Intralogistics Market

Hardware comprises roughly 48% of the market. The hardware segment within intralogistics includes AS/RS, conveyor systems, robotic arms, and AGVs for optimizing material handling, storage, and retrieval activities. Hardware has been the backbone to warehouse automation in terms of labor force reduction, speed, and accuracy in fulfillment and inventory control.

By End User, Retail and E-commerce, holds the highest CAGR of 10.8%

In intralogistics, the retail and e-commerce market is growing fast as business's are increasing demand for faster and efficient order fulfillment. The automation solutions covered in this segment include robotic picking, AS/RS, conveyor systems, and advanced WMS. These technologies allow the streamlined movement, storage, and retrieval of goods, thereby enabling these businesses to manage large volumes of inventory and ensure timely delivery.

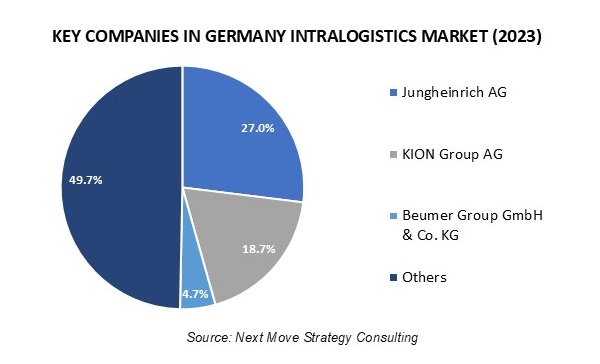

Competitive Landscape

The promising players operating in Germany intralogistics industry include Jungheinrich AG, KION Group AG, Beumer Group GmbH & Co. KG, Honeywell International Inc., Knapp AG, Vanderlande Industries B.V., Midea Group Co., Ltd., AutoStore System AS, Daifuku Co., Ltd., SSI Schafer AG, ALFOTEC GmbH, SICK AG, GDI Intralogistics GmbH, BOWE Group, Hormann Intralogistics, psb intralogistics GmbH, LTW Intralogistics GmbH, KEBA Intralogistics, DLL Group, Possehl Group among others.

These players are engaged in various partnership, product launches, and acquisition across various regions to maintain their dominance in Germany intralogistics market.

|

Date |

Company |

Recent Developments |

|

October 2024 |

Vanderlande Industries B.V. |

Vanderlande acquired Siemens Logistics, a company specializing in baggage and cargo handling solutions. This acquisition aims to enhance Vanderlande's capabilities in automated logistics by leveraging Siemens' advanced technologies and expertise in intralogistics. |

|

September 2024 |

Midea Group Co., Ltd. |

KUKA launched a new digital segment to enhance its IoT, data analytics, and simulation software capabilities. This initiative incorporates its existing brands, Device Insight and Visual Components, aiming to improve transparency and efficiency in manufacturing processes for clients. |

|

August 2024 |

Kion Group |

KION Group partnered with Eurofork to distribute its E4CUBE pallet shuttle systems across the EMEA region, enhancing KION's automated solution offerings. This collaboration aims to simplify access to advanced automation technologies for customers. |

|

March 2024 |

SSI Schaefer Group |

SI SCHAEFER Group launched LOGIONE, a new stand-alone software for its vertical lift module (VLM) that is designed to enhance warehouse efficiency. |

|

July 2023 |

AutoStore System |

AutoStore expanded its presence in Germany by opening a new office. This location marks a strategic move for the company, that is a leader in automated storage and retrieval systems. |

|

June 2023 |

Beumer Group GmbH and Co. KG |

BEUMER Group acquired The Hendrik Group Inc., a prominent manufacturer of air-supported belt conveyors. This strategic acquisition allows BEUMER Group to enhance its product offerings and strengthen its position in the intralogistics market. |

|

February 2023 |

Midea Group Co., Ltd. |

KUKA a subsidiary of Media Group launched the KMP 600-S diffDrive an automated guided vehicle (AGV) designed to enhance efficiency in intralogistics to support material handling with a payload capacity of 600 kg. |

|

March 2022 |

SSI Schaefer |

SSI SCHAEFER Group acquired DS Automotion to enhance its capabilities in autonomous mobile robotics and AGVs while allowing DS Automotion to maintain its operations under its established brand. |

Germany Intralogistics Market Key Segments

By Component

-

Hardware

-

Automated Storage and Retrieval Systems (AS/RS)

-

Unit-Load AS/RS

-

Mini-Load AS/RS

-

Vertical Lift Modules (VLMs)

-

Carousel AS/RS

-

-

Industrial Robots

-

Mobile Robots

-

Automated Guided Vehicle (AGV)

-

Autonomous Mobile Robot (AMR)

-

-

Conveyor Systems

-

Sortation Systems

-

-

Software

-

Services

By End Users

-

Logistics

-

Food And Beverages

-

Retail And E-Commerce

-

Automotive

-

Chemicals

-

Pharmaceuticals

-

Airport

-

Mining

Key Players

-

Jungheinrich AG

-

KION Group AG

-

Beumer Group GmbH & Co. KG

-

Honeywell International Inc.

-

Knapp AG

-

Vanderlande Industries B.V.

-

Midea Group Co., Ltd.

-

AutoStore System AS

-

Daifuku Co., Ltd.

-

SSI Schafer AG

-

ALFOTEC GmbH

-

SICK AG

-

GDI Intralogistics GmbH

-

BOWE Group

-

Hormann Intralogistics

-

PSB intralogistics GmbH

-

LTW Intralogistics GmbH

-

KEBA Intralogistics

-

DLL Group

-

Possehl Group

REPORT SCOPE AND SEGMENTATION:

|

Parameters |

Details |

|

Market Size in 2024 |

USD 4.51 Billion |

|

Revenue Forecast in 2030 |

USD 8.22 Billion |

|

Growth Rate |

CAGR of 10.5% from 2025 to 2030 |

|

Analysis Period |

2024–2030 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025–2030 |

|

Market Size Estimation |

Billion (USD) |

|

Growth Factors |

|

|

Companies Profiled |

20 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent up to 80 working hours of analysts) after purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

Speak to Our Analyst

Speak to Our Analyst