Italy Intralogistics Market Component (Hardware, Software, and Services), by Hardware (Automated Storage and Retrieval Systems (AS/RS), Industrial Robots, Mobile Robots, Conveyor Systems, and Sortation Systems), by AS/RS (Unit-Load AS/RS, Mini-Load AS/RS, Vertical Lift Modules (VLMs), Carousel AS/RS), and by End-User ( Logistics, Food and Beverages, Retail and E-Commerce, Automotive, Chemicals, Pharmaceuticals, Airport, and Mining) –Opportunity Analysis and Industry Forecast, 2025–2030

Industry: Construction & Manufacturing | Publish Date: 27-Feb-2025 | No of Pages: 106 | No. of Tables: 74 | No. of Figures: 42 | Format: PDF | Report Code : CM1046

US Tariff Impact on Italy Intralogistics Market

Trump Tariffs Are Reshaping Global Business

Italy Intralogistics Market Overview

Italy Intralogistics Market size was valued at USD 2.22 billion in 2024 and is predicted to reach USD 3.71 billion by 2030, registering a CAGR of 8.2% from 2025 to 2030.

Growth in e-commerce, development in the automobile industry, and a shift to Industry 5.0, is driving intralogistics industry forward in Italy. Robotics and warehouse management systems supported by artificial intelligence appeal to companies wanting to enhance retail and e-commerce logistics performance, but high setup costs are proving to be the major deterrent to small and medium-sized enterprises.

Intralogistics automation in Italy will be further boosted by the upcoming opportunities created through the growing integration of AI, while leading players such as Kion Group AG (Dematic), Jungheinrich AG, Vanderlande Industries, and SSI Schaefer Systems International continue to introduce innovative solutions to strengthen their market presence.

E-Commerce Growth Accelerates the Demand for Intralogistics Solutions

Italian e-commerce development consequently raises demand for effective intralogistics solutions, involving automation of storage and retrieval systems, robotics, and other tools in order to cut operation time and facilitate timely deliveries.

According to the European E-Commerce Report 2024, the share of e-shoppers increased from 38% in 2019 to 53% in 2024, thus representing an increase of 15% in 5 years. The surge in e-commerce accelerates the demand for the proper implementation of advanced technologies for timely dispatch and delivery, maintaining the accuracy within goods handling.

Growing Automotive Sector Drives the Industry Growth

The expansion of the market is further fueled by the growing automotive sector in Italy, that necessitates the use of intralogistics solutions for optimizing the deployment of vehicle components and goods on the factory floor and thereby enhancing productivity and efficiency.

International Organisation of Motor Vehicle Manufacturers states that, the number of total vehicles production including cars and commercial vehicle summed 796,394 in 2022 in Italy and the same rose to 880,085 reflecting an increase of 10.5% in 2023. The boosting automotive sector in the region requires higher production of vehicles that drives the path towards intralogistics solution, thereby boosting the market.

Transition Towards Industry 5.0 Boosts the Market Growth

The shift toward industry 5.0 is driving of Italy intralogistics market expansion by enhancing human-machine collaboration and intelligent automation. This transformation is increasing the adoption of advanced warehouse management systems, collaborative robots, and autonomous mobile robots to optimize logistics operations.

For instance, in February 2024, the Council of Ministers in Italy signed the Transition Plan 2.0 allocating USD 6.56 billion aimed at improving the human-machine interaction in warehouses. As Italy's Transition Plan 5.0 accelerates digitalization in manufacturing and warehousing, businesses are investing in advanced intralogistics solutions to improve efficiency and reduce downtime.

High Initial Investment Hampers Market Expansion

The high upfront cost of advanced intralogistics solutions is considered a major restraint to the Italy intralogistics market growth. Automation tools such as conveyor systems, warehouse management software, mobile robots, and crane systems are expensive to procure and it becomes quite difficult for small and mid-sized players to invest in such technologies.

Furthermore, continuous expenses regarding maintenance, upgrade, and training of the staff further increase the cost burden. This huge investment requirement discourages widespread adoption, thus limiting the integration of advanced intralogistics solutions across various industries.

Integration of Artificial Intelligence into Intralogistics Solutions Creates Future Opportunities

Integration of artificial intelligence in intralogistics solutions is anticipated to create significant opportunities in future. Artificial intelligence powered robots autonomously navigate warehouse from pickup station to hand over station relieving human workers from repetitive and ergonomically difficult task.

For instance, in October 2023, Locus Robotics launched its AI powered autonomous mobile robots featuring collaborative adaptability with human associates in Italian market to enable companies to cost-effectively scale and drive future automation. This product launch introduced the company’s advanced solution to widening Italian industry nurturing seeds for future automation.

By Component, Hardware Holds the Dominant Share in the Italy Intralogistics Market

Hardware comprises nearly 47% of Italy intralogistics market demand, driven by the growing need for automation in warehousing and the production area. The companies are moving toward improving operational efficiency, where the demand for efficient material handling equipment, such as conveyor systems and robotic solutions, continued to rise. It accelerates processes and reduces dependence on manual labor and these factors are driving hardware maintain its dominance in the market.

By End User, Retail and E-Commerce, Holds the Highest CAGR of 11.0%

E-commerce contributes to have the fastest growth rate in the intralogistics market in Italy, owing to the rapid improvement of online retail and the ever-growing demand for faster order accomplishment. As e-commerce businesses grow, it creates need for effective and automated logistics solutions, including order picking, sorting, and last-mile delivery. Advanced intralogistics technologies such as robotics and AI are thus being implemented to ease operations and meet customer demands for speed and accuracy.

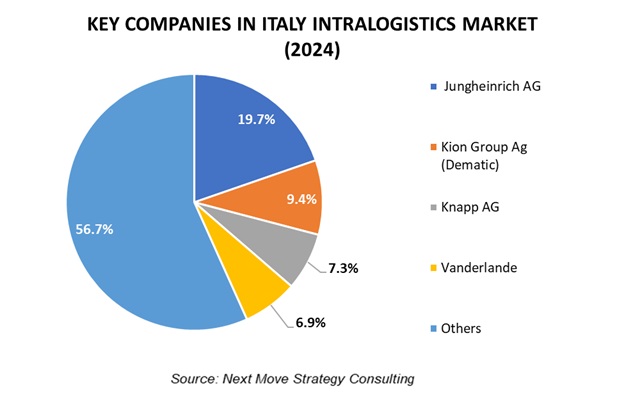

Competitive Landscape

The promising key players operating in the Italy Intralogistics industry include Kion Group AG (Dematic), Jungheinrich AG, Vanderlande Industries, SSI Schaefer Systems International, OMRON Corporation, Ciemmecalabria Srl, AutoStore Systems AS, BEUMER Group GmbH & Co. KG, Midea Group (Swisslog Holding AG + KUKA AG), Interroll Group, Yaskawa Italia Srl, TGW Logistics Group GmbH, System Logistics S.p.A., Rockwell Automation, Inc., Cassioli Srl, LCS Group, Honeywell International Inc., Knapp AG, Zucchetti S.p.A., Generix Group SA., among others. Other companies include Comau S.p.A., E.c.s. S.r.l. and others.

These players are engaged in various product launches and partnership across to maintain their dominance in the Italy intralogistics market.

For instance, in July 2024, Comau partnered with One Equity Partners to accelerate growth in Italy’s industrial automation sector. This collaboration aims to enhance Comau’s expertise in robotics, digital manufacturing, and logistics automation, strengthening its role in advancing Italy’s intralogistics market.

In addition, in October 2023, AutoStore launched the R5 Pro robot, boosting automation in Italy’s intralogistics market by enhancing high-throughput warehouse operations. Its advanced capabilities improved efficiency, optimized storage, and streamlined order fulfillment, accelerating the adoption of automated storage and retrieval systems in Italian warehouses.

Further, in February 2023, TGW Group launched Plancise, a software solution designed to enhance the planning and optimization processes within logistics and supply chain management.

Italy Intralogistics Market Key Segments

By Component

-

Hardware

-

Automated Storage and Retrieval Systems (AS/RS)

-

Unit-Load AS/RS

-

Mini-Load AS/RS

-

Vertical Lift Modules (VLMs)

-

Carousel AS/RS

-

-

Industrial Robots

-

Mobile Robots

-

Automated Guided Vehicle (AGV)

-

Autonomous Mobile Robot (AMR)

-

-

Conveyor Systems

-

Sortation Systems

-

-

Software

-

Services

By End-User

-

Logistics

-

Food And Beverages

-

Retail And E-Commerce

-

Automotive

-

Chemicals

-

Pharmaceuticals

-

Airport

-

Mining

Key Players

-

Kion Group AG (Dematic)

-

Jungheinrich AG

-

Vanderlande Industries

-

SSI Schaefer Systems International

-

OMRON Corporation

-

Ciemmecalabria Srl

-

AutoStore Systems AS

-

BEUMER Group GmbH & Co. KG

-

Midea Group (Swisslog Holding AG + KUKA AG)

-

Interroll Group

-

Yaskawa Italia Srl

-

TGW Logistics Group GmbH

-

System Logistics S.p.A.

-

Rockwell Automation, Inc.

-

Cassioli Srl

-

LCS Group

-

Honeywell International Inc.

-

Knapp AG

-

Zucchetti S.p.A.

-

Generix Group SA

REPORT SCOPE AND SEGMENTATION:

|

Parameters |

Details |

|

Market Size in 2024 |

USD 2.22 Billion |

|

Revenue Forecast in 2030 |

USD 3.71 Billion |

|

Growth Rate |

CAGR of 8.2% from 2025 to 2030 |

|

Analysis Period |

2024–2030 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025–2030 |

|

Market Size Estimation |

Billion (USD) |

|

Growth Factors |

|

|

Companies Profiled |

20 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent up to 80 working hours of analysts) after purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

Speak to Our Analyst

Speak to Our Analyst