Middle East Aluminium Market by Type (Primary and Secondary), by Product Type (Flat-Rolled, Castings, Extrusions, Forgings, Powder & Paste, Billets, Wire Rods, and Other), By Alloy Series (1xxx Series, 2xxx Series, 3xxx Series, 4xxx Series, 5xxx Series, 6xxx Series, 7xxx Series), by End User (Transportation, Machinery & Equipment, Construction, Packaging, Electrical Engineering, and Other End Users)– Opportunity Analysis and Industry Forecast, 2024–2030

Industry: Materials and Chemical | Publish Date: 23-Apr-2025 | No of Pages: 218 | No. of Tables: 152 | No. of Figures: 97 | Format: PDF | Report Code : MC1365

US Tariff Impact on Middle East Aluminium Market

Trump Tariffs Are Reshaping Global Business

Middle East Aluminium Market Overview

Middle East Aluminium Market size was valued at USD 11.33 billion in 2023, and is predicted to reach USD 15.90 billion by 2030, at a CAGR of 5.0% from 2024 to 2030.

The aluminum market covers the industry focused on producing, distributing, and utilizing aluminum, a light and silvery metal. Aluminum constitutes approximately 8% of the Earth's crust and is recognized for its low density, high strength, and resistance to corrosion from a natural oxide layer.

These properties make aluminum crucial in industries like aerospace, automotive, construction, packaging, and electronics. Its lightweight nature enhances efficiency, particularly in transportation. Aluminum is extracted from bauxite ore through the Bayer process and electrolysis. Recent advancements in energy efficiency and recycling have made production more sustainable, aiding industry development.

Aluminum Recycling Drives the Market Growth in the Middle East

The growth of the aluminum market is significantly driven by the region's increasing focus on aluminum recycling. Recycling offers numerous advantages, including substantial energy savings, conservation of resources, and reduced environmental impact. For example, in January 2023, Emirates Global Aluminum, the largest industrial company in the United Arab Emirates, launched the Aluminum Recycling Coalition.

This initiative aims to significantly enhance aluminum recycling practices in the UAE, with a particular focus on encouraging the recycling of beverage cans among consumers.

This heightened emphasis on recycling is helping to propel the Middle East aluminum market growth in the region. In June 2023, L'Occitane launched its ‘Gift of Nature’ campaign in the region, highlighting its commitment to sustainability. This campaign features products made from recycled aluminum, reflecting the brand's dedication to eco-friendly practices.

Expansion of Infrastructure Projects is Driving Middle East’s Aluminum Market

The expansion of infrastructure projects is a significant driver of the aluminum market growth in the Middle East. The region is investing heavily in developing new airports, highways, and urban centers, that creates a substantial demand for aluminum. This versatile material is essential for various construction applications, including building facades, structural components, and transportation infrastructure.

The increasing scale and complexity of infrastructure projects in the Middle East require durable, lightweight materials like aluminum, thereby boosting its market demand. As these projects progress, the need for aluminum to meet construction standards and support infrastructure development continues to grow, further driving Middle East aluminium market expansion.

Environmental and Regulatory Constraints Hinders the Growth of Aluminium Market

The aluminum industry encounters significant challenges stemming from strict environmental regulations and sustainability requirements. Compliance with emissions control, waste management, and energy efficiency targets often leads to increased operational costs for producers.

Adhering to these rigorous standards demands substantial investments in technologies and processes designed to minimize the environmental impact of aluminum production. Although these measures are essential for promoting a greener industry, they also add complexity and raise production costs, ultimately impacting the efficiency and profitability of aluminum manufacturing.

Sustainable Packaging Creates Ample Future Opportunities

The increasing emphasis on sustainable packaging presents substantial growth opportunities for the aluminum market. Aluminum is highly valued for packaging applications such as cans, bottles, and foils due to its recyclability and effectiveness in preserving product quality and freshness.

As eco-conscious consumers and brands strive to minimize their environmental impact, they are increasingly opting for aluminum as their preferred packaging material. This choice helps reduce waste and supports sustainability goals, contributing to the growth of the aluminum market.

Competitive Landscape

Several key players operating in the Middle East aluminium industry are Emirates Global Aluminium (EGA), PETRA Aluminum Company LTD., Condor Group, Ma’aden Aluminium, Elite Extruction LLC, White Aluminium Enterprises LLC, Al Ghurair Group, Sykon Aluminium, Alico Group, Gulf Extrusion Company LLC, OSE Industries LLC, Alcoa Corporation, Aluminium Products Company (ALUPCO), Sohar Aluminium, Rio Tinto, and others.

Middle East Aluminium Market Key Segments

By Type

-

Primary

-

Secondary

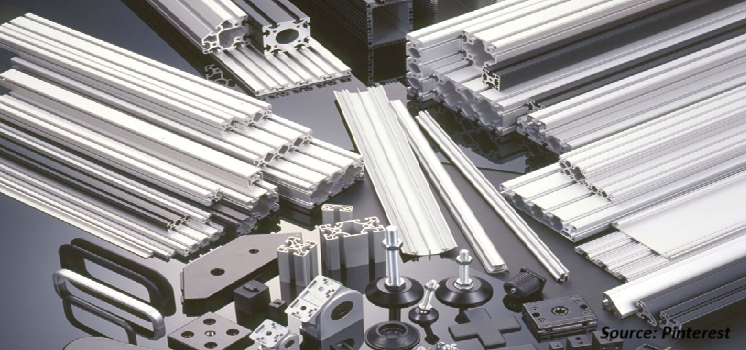

By Product Type

-

Flat-Rolled

-

Castings

-

Extrusions

-

Forgings

-

Powder & Paste

-

Billets

-

Wire Rods

-

Other Types

By Alloy Series

-

1xxx Series

-

2xxx Series

-

3xxx Series

-

4xxx Series

-

5xxx Series

-

6xxx Series

-

7xxx Series

By End User Industry

-

Transport

-

Aerospace

-

Automotive

-

Marine

-

-

Machinery & Equipment

-

Construction

-

Packaging

-

Food & Beverage

-

Cosmetics

-

Others

-

-

Electrical Engineering

-

Other End Usres

By Region

-

Middle East

-

Saudi Arabia

-

United Arab Emirates (UAE)

-

Israel

-

Qatar

-

Kuwait

-

Oman

-

Other Countries

-

Key Players

-

Emirates Global Aluminium (EGA)

-

PETRA Aluminum Company LTD.

-

Condor Group

-

Ma’aden Aluminium

-

Elite Extruction LLC

-

White Aluminium Enterprises LLC

-

Al Ghurair Group

-

Sykon Aluminium

-

Alico Group

-

Gulf Extrusion Company LLC

-

OSE Industries LLC

-

Alcoa Corporation

-

Aluminium Products Company (ALUPCO)

-

Sohar Aluminium

-

Rio Tinto

REPORT SCOPE AND SEGMENTATION:

|

Parameters |

Details |

|

Market Size in 2023 |

USD 11.33 Billion |

|

Revenue Forecast in 2030 |

USD 15.90 Billion |

|

Growth Rate |

CAGR of 5.0% from 2024 to 2030 |

|

Analysis Period |

2023–2030 |

|

Base Year Considered |

2023 |

|

Forecast Period |

2024–2030 |

|

Market Size Estimation |

Billion (USD) |

|

Growth Factors |

|

|

Companies Profiled |

15 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent up to 80 working hours of analysts) after purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

Speak to Our Analyst

Speak to Our Analyst