Netherlands Aluminum Market by Type (Primary, Secondary), by Product Type (Flat-Rolled, Casting, Extrusions, Forgings, Powder & Paste, Billets, Wire Rods, Other Types), by Alloy Series (1xxx Series, 2xxx Series, 3xxx Series, 4xxx Series, 5xxx Series, 6xxx Series, 7xxx Series) by End User (Transportation, Aerospace, Automotive, Marine, Machinery & Equipment, Construction, Packaging, Food & Beverage, Cosmetics, Others, Other End Users) – Opportunity Analysis and Industry Forecast, 2024–2030

Industry: Materials and Chemical | Publish Date: 21-Mar-2025 | No of Pages: 160 | No. of Tables: 123 | No. of Figures: 68 | Format: PDF | Report Code : MC1351

US Tariff Impact on Netherlands Aluminium Market

Trump Tariffs Are Reshaping Global Business

Netherlands Aluminium Market Overview

Netherlands Aluminium Market size was valued at USD 8.19 billion in 2023, and is predicted to reach USD 11.33 billion by 2030, at a CAGR of 4.7% from 2024 to 2030.

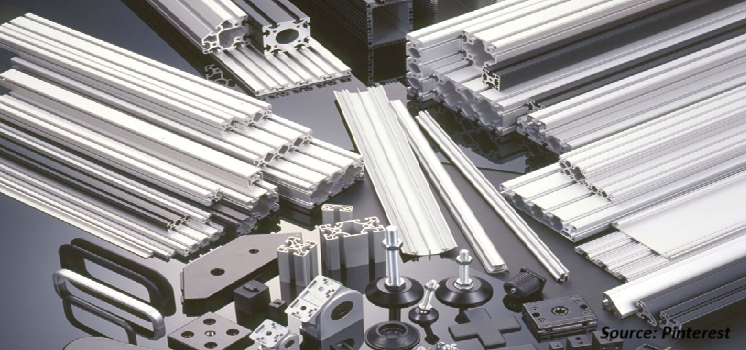

The aluminum market involves the sector engaged in the production, distribution, and application of aluminum, a lightweight and silvery-white metal. Aluminum constitutes about 8% of the Earth's crust and is known for its low density, high strength, and natural corrosion resistance due to an oxide layer.

These attributes make aluminum valuable for aerospace, automotive, construction, packaging, and electronics industries. Its lightweight nature improves efficiency, especially in transportation.

The production of aluminum involves processing bauxite ore using the Bayer process and electrolysis. Improvements in technology and recycling have enhanced production sustainability, supported industry growth and reduced environmental impact.

High Aluminum Imports Drive Market Growth in the Netherlands

The Netherlands’ imports large quantities of aluminum to support its major industries, including manufacturing, automotive, aerospace, construction, and packaging. This demand drives market growth.

In 2022, the Netherlands imported about 35 million metric tonnes of aluminum, making it the second-largest importer in Europe, according to the Global Aluminum Trade Monitor. The country imports aluminum to satisfy domestic needs, take advantage of trade networks, improve processing capabilities, and meet sustainability goals.

Strong Industrial Sector Drives the Demand for Aluminium in Netherlands

The robust industrial sector significantly drives the growth of the aluminum market. The country’s advanced manufacturing industries, including automotive, aerospace, and construction, rely heavily on aluminum for its strength, lightweight properties, and versatility. As a key component in these sectors, aluminum is essential for producing high-performance parts and infrastructure.

According to industry reports, the Netherlands strong industrial base has led to substantial aluminum imports to support ongoing and expanding projects. This high demand for aluminum reflects the sector's growth and innovation, with aluminum playing a crucial role in advancing technological and structural developments. As industries continue to expand is further fueling Netherlands aluminium market growth.

Environmental and Regulatory Constraints Hinders the Growth of Aluminium Market

The aluminium industry faces challenges from environmental regulations and sustainability requirements, including emissions control, waste management, and energy efficiency targets, that leads to higher operational costs for some producers.

Compliance with strict emissions standards, waste management rules, and energy consumption goals often necessitates substantial investments and efforts to reduce the environmental impact of aluminium production.

These sustainability measures are designed to minimize emissions, ensure responsible waste management, and promote energy efficiency. Although these regulations are essential for fostering a greener and more sustainable industry, they also contribute to the overall costs and complexities of aluminium production.

Sustainable Packaging Creates Ample Future Opportunities

The increasing emphasis on sustainable packaging presents substantial growth opportunities for the aluminum market. Aluminum is well-suited for packaging applications such as cans, bottles, and foils because of its recyclability and effectiveness in preserving product quality and freshness.

As eco-conscious consumers and brands seek to minimize their environmental impact, they are increasingly selecting aluminum as their preferred packaging material. This choice helps reduce waste and supports sustainability, aligning with broader environmental goals. The growing demand for eco-friendly packaging solutions is a major driver of the Netherlands aluminium market expansion.

Competitive Landscape

Several key players operating in Netherlands aluminium industry include Aldel, F.H.S., Sapa Extrusions, Reukema Blocq & Maneschijn, Comhan Holland B.V., E-Max Aluminium (Dilsen group), Janivo Holding B.V., Apt Hiller & Maldaner GmbH, Nedal Aluminium (Purso Group Oy), Norsk Hydro, Rena Castings B.V., Constellium SE, Novelis Netherlands B.V., AMG Advanced Metallurgical Group N.V., Mifa Aluminium BV and others.

Netherlands Aluminium Market Key Segments

By Type

-

Primary

-

Secondary

By Product Type

-

Flat-Rolled

-

Casting

-

Extrusions

-

Forgings

-

Powder & Paste

-

Billets

-

Wire Rods

-

Other Types

By Alloy Series

-

1xxx Series

-

2xxx Series

-

3xxx Series

-

4xxx Series

-

5xxx Series

-

6xxx Series

-

7xxx Series

By End User

-

Transportation

-

Aerospace

-

Automotive

-

Marine

-

-

Machinery & Equipment

-

Construction

-

Packaging

-

Food & Beverage

-

Cosmetics

-

Others

-

-

Electrical Engineering

-

Other End Users

Key Players

-

Aldel

-

F.H.S.

-

Sapa Extrusions

-

Reukema Blocq & Maneschijn

-

Comhan Holland B.V.

-

E-Max Aluminium (Dilsen group)

-

Janivo Holding B.V.

-

Apt Hiller & Maldaner GmbH

-

Nedal Aluminium (Purso Group Oy)

-

Norsk Hydro

-

Rena Castings B.V.

-

Constellium SE

-

Novelis Netherlands B.V.

-

AMG Advanced Metallurgical Group N.V.

-

Mifa Aluminium BV

REPORT SCOPE AND SEGMENTATION:

|

Parameters |

Details |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Speak to Our Analyst

Speak to Our Analyst