Packaging Machinery Market by Machine Type (Filling & Dosing, Labelling, Wrapping & Bundling, Bottling Line, Case Handling, and Others), and by End Users (Food & Beverages, Pharmaceuticals, Chemicals, and Others) – Global Opportunity Analysis and Industry Forecast, 2025-2030

US Tariff Impact on Packaging Machinery Market

Trump Tariffs Are Reshaping Global Business

Packaging Machinery Market Overview

The global Packaging Machinery Market size was valued at USD 56.75 billion in 2024 and is predicted to reach USD 76.20 billion by 2030 with a CAGR of 5.20% from 2025-2030.

The factors such as the expansion of increasing food industry, growing logistics, and technological advancements drives the growth of the market. However, the high investment costs restraint the market growth. On the contrary, the integration of automation in packaging machinery is expected to create significant growth opportunities in the coming years.

Moreover, the top players such as IMA Industria Machine Automatiche S.p.A., Ranpak Holdings Corp., and Syntegon Technology GmbH are taking various initiates such as product launches and partnership to enhance production efficiency, improve sustainability, and drive innovation in automated packaging solutions. As the market progresses, the increasing adoption of smart packaging technologies and advancements in automation support steady growth and broader implementation across industries.

Increasing Food Industry Boosts the Market Expansion

Rising consumer demand for convenience-equipped sustainable products encourages food producers to explore innovative advanced packaging solutions for changing preferences driving the market for packaging machinery. The World Economic Forum report that the global food market reached USD 9.12 trillion in 2024 with a growth of 6.7 percent annually. This growth increases the need for packaging equipment, allowing manufacturers to enhance production capabilities and innovate solutions to meet evolving food packaging needs.

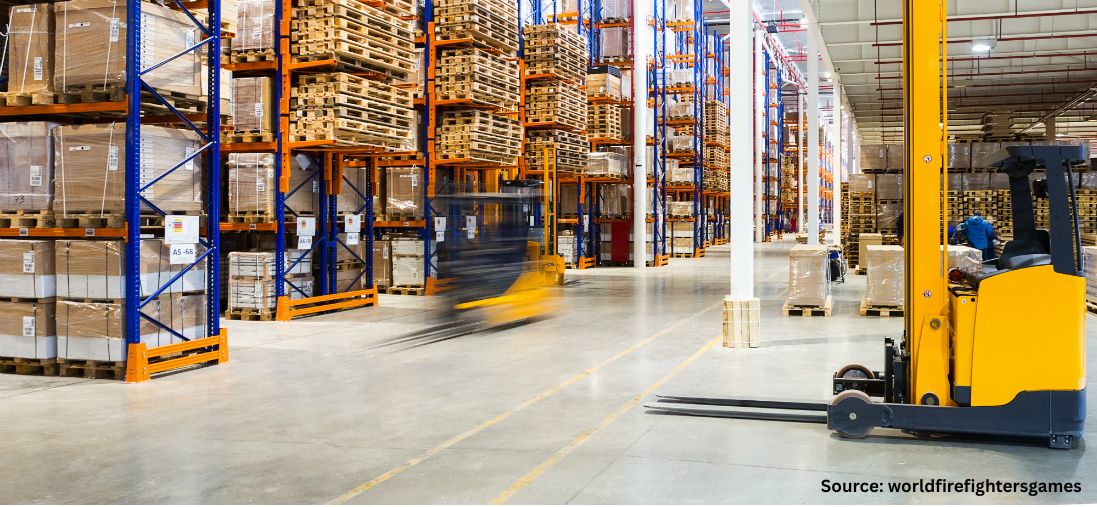

Growing Logistics Sector Drives the Market Expansion

The expansion of logistics industry fuels the market growth as it requires innovative packaging systems that combine efficient volume handling with protective features and delivery speed optimization.

The World Economic Forum reports that the global logistics market rose from USD 8.46 trillion in 2023 to USD 18.24 trillion by 2030 with a growth of 116% over 7 years. The logistics sector's rapid extension requires innovative developments in packaging machinery to provide more efficient and reliable solutions for product distribution, thereby fueling the packaging machinery market growth.

Technological Advancements Boosts the Growth of the Market

Technologies advancements including turnkey systems in the production process contributes to growth in the market as they offer packaged solutions to increase packaging effectiveness. These innovations in packaging machinery enable manufacturers to automate processes, minimize operational delays and minimize labor costs that leads to increased productivity and faster time-to-market.

For instance, in July 2023, EndFlex Packaging Machinery introduced a turnkey system for filling bottles into cartons, aimed at enhancing efficiency in packaging. Such advancements drive the market growth by facilitating operational improvements and addressing the rising demand for efficiency in production lines.

High Investment Costs Hinders the Market Expansion

The high investment costs associated with packaging machinery market expansion, as these expenses deter small and medium-sized enterprises from adopting advanced technologies, thereby limiting their operational capabilities.

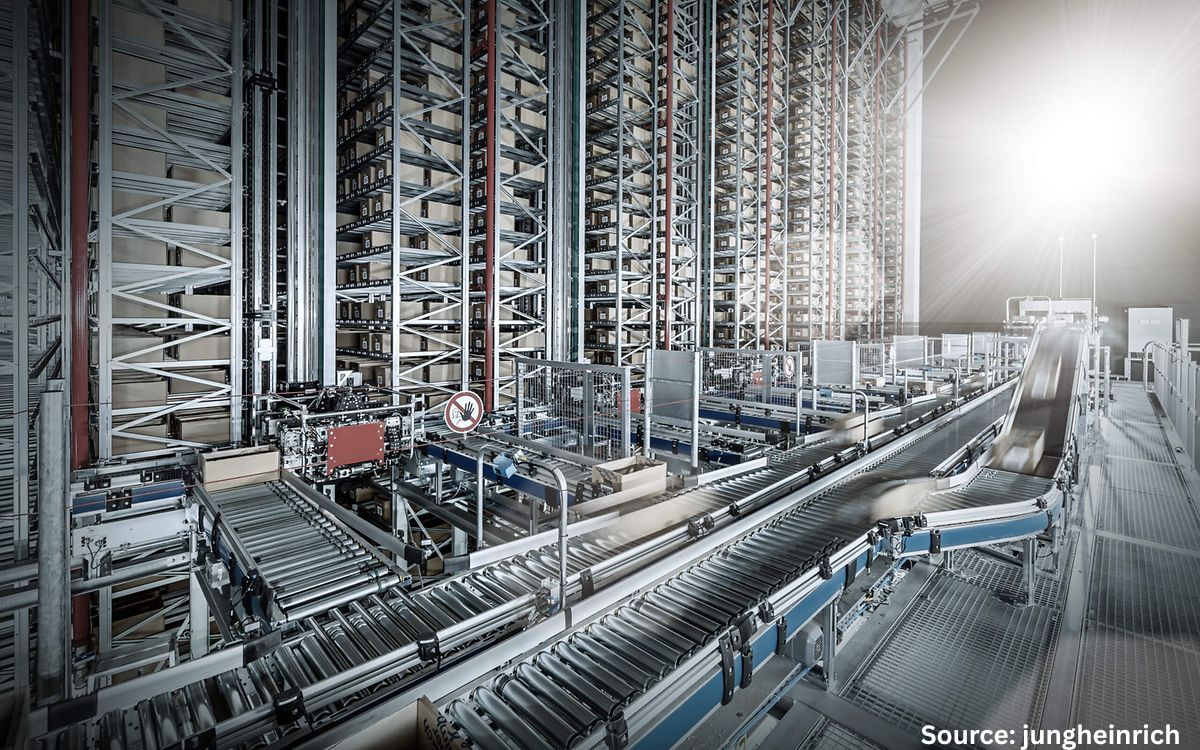

Integration of Automation in Packing Machinery Creates a Future Opportunity for the Market

The integration of automation in packaging machinery serves a significant growth opportunity in the future. The automation of production systems helps businesses process more while maintaining high quality standards and achieving faster production stages to keep up with increasing market needs while reducing staffing expenses. This packaging technology advancement delivers improved process efficiency alongside better product quality while minimizing waste costs that leads to increased profitability for various industries.

Market Segmentations and Scope of the Study

The packaging machinery market report is segmented on the basis of machine type, end users, and region. On the basis of machine type, the market is classified into filling & dosing, labelling, wrapping & bundling, bottling line, case handling, and others. On the basis of end users, the market is divided into food & beverages, pharmaceuticals, chemicals, and others. The regional breakdown includes regions such as North America, Europe, Asia-Pacific, and the Rest of the World (RoW).

Geographical Analysis

Asia-Pacific dominates the packaging machinery market share and is expected to continue its dominance during the forecast period. This is due to the increasing trend in food processing industry in the region that creates the demand for more packaging systems. The higher consumption of processed food results in high demand for packaging solution to meet safety, durability and hygiene standards for food packaging.

As per latest data from Ministry of Commerce & Industry, India Food processing market valued at USD 866 billion in 2022 and is set to reach USD 1,274 billion in 2027, a growth of 47.1% within a 5-year span. The remarkable growth of the food processing sector enhances the market expansion by increasing demand for innovative equipment that ensures product quality and extends shelf life.

Additionally, the presence of key players such as Jochamp, Eliter Packaging Machinery, and Kawashima Packaging Machinery Ltd., further fuels the growth of the packaging machinery industry by implementing innovative technologies and solutions to enhance performance and efficiency in the region.

For instance, in July 2024, Jochamp recently launched the JCZ-250 series of shisha dosing packaging machines to address common issues in shisha tobacco packaging, including tobacco extrusion and weight inaccuracies caused by the tobacco's viscosity. These innovations boost packaging efficiency and enable these companies to align more closely with consumer preferences, thereby propelling market growth.

On the other hand, North America is expected to experience steady growth in the packaging machinery industry due to expansion of the logistics industry in the region. The rising need for time and cost-effective packaging materials & processes both in e-commerce & retail industries fuels the market growth.

According to the world economic forum published report, the North America logistics market size valued at USD 1.97 trillion in 2023 that is set to grow at a 111.7% growth rate to reach USD 4.17 trillion by 2030. Thus, the strong, sustainable development regulates the logistic activity to increase the demand for new packaging equipment to improve outstanding logistics performances with lower prices.

Also, the expansion of the cosmetics sector in the region propels market growth as increasing need for very unique and appealing packaging options encourages manufacturers to invest in advanced technologies.

From the 2022 report of the International Trade Administration (ITA), the cosmetic market of Canada stood at USD 1.24 billion in 2021 and it is expected to reach USD 1.8 billion in 2024 with an annual growth rate of 1.45 percent. Therefore, improvement in the cosmetics market increases demand for packaging that caters for consumer’s need and hence improves market efficiency and competitiveness.

Competitive Landscape

The packaging machinery industry comprises of various key market players such as IMA Industria Macchine Automatiche S.p.A., Ranpak Holdings Corp., Syntegon Technology GmbH, Bradman Lake Group Ltd., Douglas Machine Inc., Coesia S.p.A, Jochamp, Cama Group, Eliter Packaging Machinery, GEA Group AG, Rovema GmbH, KHS Group, Quest Industrial LLC, Sacmi, SIG Group, and others. These market players continue to adopt various market development strategies including product launches and partnership to maintain their dominance in the market.

For example, in August 2024, GEA introduced a new packaging machine that enhance efficiency and sustainability in food packaging. This technology delivers adaptable environmentally-friendly solutions that operate with increased efficiency and decreased material needs to fulfill the increasing food industry commitment to sustainability.

Also, in July 2024, Cama Group launched a new monoblock top loading (MTL) system to boost productivity and reduce machinery footprint in the multipack packaging market. This system addresses the need for efficient variety pack solutions, especially in sectors such as coffee capsule production.

Additionally, in July 2024, Eliter Packaging Machinery launched the multi-wrap c-80s, a high-speed automatic sleeving machine that wraps up to 80 multipacks per minute, applying cardboard sleeves around various container formats.

Furthermore, in April 2024, IMA Industria Macchine Automatiche S.p.A. partnered with ALLIEDFLEX Technologies, Inc. to enhance the sales and marketing of its IMA FILLSHAPE series standup pouch packaging machinery in North America. This collaboration focuses on non-food sectors such as Home and Personal Care and Techno-Chemical markets.

Moreover, in September 2022, Ranpak launched its automated packaging solution Cut’it! EVO. This innovative machine enhances packaging efficiency by scaling up output, reducing operating costs, and improving sustainability.

Key Benefits

-

The report provides quantitative analysis and estimations of the packaging machinery industry from 2025 to 2030, which assists in identifying the prevailing industry opportunities.

-

The study comprises a deep-dive analysis of the current and future packaging machinery market trends to depict prevalent investment pockets in the industry.

-

Information related to key drivers, restraints, and opportunities and their impact on the packaging machinery industry is provided in the report.

-

Competitive analysis of the key players, along with their market share is provided in the report.

-

SWOT analysis and Porters Five Forces model is elaborated on the study.

-

Value chain analysis in the market study provides a clear picture of roles of stakeholders.

Packaging Machinery Market Key Segments

By Machine Type

-

Filling & Dosing

-

Labelling

-

Wrapping & Bundling

-

Bottling Line

-

Case Handling

-

Others

By End Users

-

Food & Beverages

-

Pharmaceuticals

-

Chemicals

-

Others

By Region

-

North America

-

The U.S.

-

Canada

-

Mexico

-

-

Europe

-

The UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Netherlands

-

Finland

-

Sweden

-

Norway

-

Russia

-

Rest of Europe

-

-

Asia-Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Indonesia

-

Singapore

-

Taiwan

-

Thailand

-

Rest of Asia-Pacific

-

-

RoW

-

Latin America

-

Middle East

-

Africa

-

Key Players

-

IMA Industria Macchine Automatiche S.p.A.

-

Ranpak Holdings Corp.

-

Syntegon Technology GmbH

-

Bradman Lake Group Ltd.

-

Douglas Machine Inc.

-

Coesia S.p.A

-

Jochamp

-

Cama Group

-

Eliter Packaging Machinery

-

GEA Group AG

-

Rovema GmbH

-

KHS Group

-

Quest Industrial LLC

-

Sacmi

-

SIG Group

REPORT SCOPE AND SEGMENTATION:

|

Parameters |

Details |

|

Market Size in 2024 |

USD 56.75 Billion |

|

Revenue Forecast in 2030 |

USD 76.20 Billion |

|

Growth Rate |

CAGR of 5.0% from 2025 to 2030 |

|

Analysis Period |

2024–2030 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025–2030 |

|

Market Size Estimation |

Billion (USD) |

|

Growth Factors |

|

|

Countries Covered |

28 |

|

Companies Profiled |

15 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent up to 80 working hours of analysts) after purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

Speak to Our Analyst

Speak to Our Analyst