Mexico Containerboard Market by Material (Virgin Fibres, Recycled Fibres, and Mixed Fibres), by Type (Linerboard and Flutting), by Wall Type (Single Face, Single Wall, Double Wall, and Triple Wall), and by End-User (Food and Beverage, Consumer Electronics, Personal Care and Cosmetics, and Others End-User) – Opportunity Analysis and Industry Forecast, 2024–2030

Industry: Materials and Chemical | Publish Date: 02-Nov-2024 | No of Pages: 111 | No. of Tables: 79 | No. of Figures: 44 | Format: PDF | Report Code : MC2666

US Tariff Impact on Mexico Containerboard Market

Trump Tariffs Are Reshaping Global Business

Mexico Containerboard Market Overview

The Mexico Containerboard Market size was valued at USD 4.46 billion in 2023 and is predicted to reach USD 5.80 billion by 2030, with a CAGR of 3.51% from 2024 to 2030. In terms of volume the market size was 6247 kilotons in 2023 and is projected to reach 9479 kilotons in 2030, with a CAGR of 5.41% from 2024 to 2030.

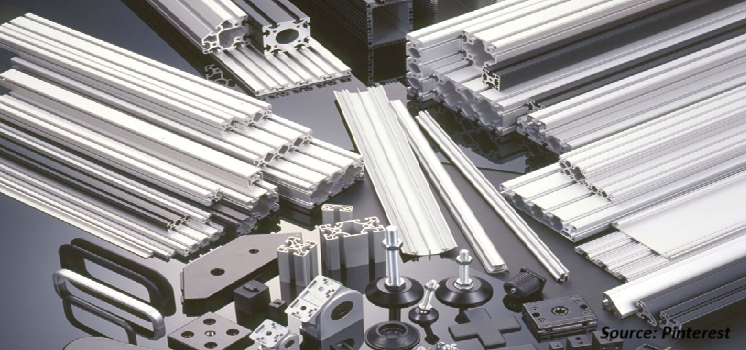

The containerboard market refers to the segment of the paper industry that produces a type of paperboard specifically designed for the manufacturing of corrugated boxes and packaging materials. This encompasses the production, distribution, and consumption of containerboard products by various industries for packaging purposes.

These containerboards are durable and strong paperboard which is primarily recycled from old corrugated containers (OCC) and mixed paper, as well as virgin fibres obtained from wood pulp. These boards offer numerous advantages, including their strength and durability, which ensures reliable protection for products during transit and storage, significantly reducing the risk of damage.

Moreover, these linerboards offer a lightweight feature which minimizes shipping costs and environmental impact. Its versatility allows for customization to meet diverse packaging needs, from small boxes to large containers.

The Rapid Expansion of the Packaging Industry Within the Nation Drives the Mexico Containerboard Market Demand

The rapid expansion of the region's packaging industry profoundly impacts the Mexico containerboard market, driving advancements in production efficiency, quality, and sustainability.

The adoption of cutting-edge technologies and automation facilitates streamlined packaging processes, effectively meeting the growing demands of sectors such as manufacturing and e-commerce.

According to a report by ITA, the Mexican packaging machinery market surged in 2022, with its total market value increasing from USD 710 million in 2021 to USD 906 million, marking a significant 27.6% expansion.

Paper and cardboard packaging materials, holding a dominant 32.7% market share, underscore their crucial role in the industry's growth. As Mexico's packaging sector evolves, it is self-assured to lead in sustainable and efficient packaging solutions.

The Increasing Trade Activities is Driving the Mexico Containerboard Market Growth

International trade plays a vital role in driving the containerboard market growth in Mexico. With the country exporting automotive parts, electronics, and food items globally, reliable packaging solutions such as containerboard are essential.

Mexico's advantageous geographical position and extensive network of free trade agreements facilitate easier access to global markets, enabling businesses to safely transport goods internationally.

In 2022, Mexico ranked as the world's 10th largest exporter, with exports totaling USD 549 billion, driven significantly by the automotive sector, that includes cars, computers, and automotive parts. As exports continue to grow, the demand for eco-friendly packaging solutions including containerboard is expected to rise, aligning with global sustainability goals.

The Presence of Alternative Materials Restrain the Market Growth

The rise of alternative packaging materials such as plastics, metals, glass, and composites pose a potential challenge to the demand for containerboard. These substitutes could threaten containerboard, especially if they offer cost advantages or superior performance in specific applications.

Innovative advancements in plastic, metal, glass, or composite materials may lead to their increased adoption by industries traditionally reliant on containerboard, potentially resulting in a loss of the Mexico containerboard market share for corrugated packaging products, particularly where alternative materials offer unique benefits.

Additionally, the increasing focus on sustainability and environmental concerns may further drive the shift towards eco-friendly and recyclable alternatives, prompting containerboard manufacturers to adapt by developing more sustainable products to meet evolving consumer and regulatory demands.

The Integration of Nanotechnology and Smart Packaging in Containerboard Creates Market Expansion

The Mexico containerboard market is expected to experience significant growth as it incorporates emerging technologies such as nanotechnology and smart packaging. These advancements enable the development of high-performance, cost-effective, and versatile containerboard products with enhanced customization and branding capabilities.

Additionally, the integration of nanotechnology and smart packaging solutions will allow for the creation of containerboard products with advanced features such as active protection and real-time monitoring.

This fusion of technology and innovation will unlock new opportunities for the Mexico containerboard market trends, driving its growth and expansion in the years to come. With these advancements driving innovation, the industry is poised for significant growth in the upcoming years.

Competitive Landscape

Several market players operating in the Mexico containerboard industry include Grupak, Sappi, Stora Enso, Green Bay Packaging, Bio-Pappel, Mondi Group, Crown Holdings, WestRock Company, Smurfit Kappa, Oji Holdings, and others.

Mexico Containerboard Market Key Segments

By Material

-

Virgin Fibres

-

Recycled Fibres

-

Mixed Fibres

By Type

-

Linerboard

-

Kraftliner

-

Testliner

-

- Flutting

By Wall Type

-

Single Face

-

Single Wall

-

Double Wall

-

Triple Wall

By End-User

-

Food and Beverage

-

Personal Care and Cosmetics

-

Consumer Electronics

-

Others End-User

Key Market Players

-

Grupak

-

Sappi

-

Stora Enso

-

Green Bay Packaging

-

Bio-Pappel

-

Mondi Group

-

Crown Holdings

-

WestRock Company

-

Smurfit Kappa

-

Oji Holdings

REPORT SCOPE AND SEGMENTATION:

|

Parameters |

Details |

|

Market Size In 2023 |

USD 4.46 Billion |

|

Revenue Forecast In 2030 |

USD 5.80 Billion |

|

Growth Rate (Value) |

CAGR of 3.51% from 2024 to 2030 |

|

Market Volume in 2023 |

6247 kilotons |

|

Volume Forecast in 2030 |

9479 kilotons |

|

Growth Rate (Volume) |

CAGR of 5.41% from 2024 to 2030 |

|

Analysis Period |

2023–2030 |

|

Base Year Considered |

2023 |

|

Forecast Period |

2024–2030 |

|

Market Size Estimation |

Billion (USD) |

|

Growth Factors |

|

|

Companies Profiled |

10 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent up to 80 working hours of analysts) after purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing And Purchase Options |

Avail customized purchase options to meet your exact research needs. |

Speak to Our Analyst

Speak to Our Analyst