Thermoplastic Composites Market by Fiber Type (Carbon Fiber Composites, Glass Fiber Composites, Natural Fiber Composites, and Others), by Resin Type (Polypropylene (PP), Polyamide (PA), Polyetheretherketone (PEEK), and Others), and by Application (Transportation, Construction, Electrical & Electronics, Sports & Leisure, and Others) – Global Opportunity Analysis and Industry Forecast 2025–2030

US Tariff Impact on Thermoplastic Composites Market

Trump Tariffs Are Reshaping Global Business

Thermoplastic Composites Market Overview

The global Thermoplastic Composites Market size was valued at USD 30.86 billion in 2024 and is predicted to reach USD 49.29 billion by 2030 with a CAGR of 8.1% from 2025-2030.

The thermoplastic composites market grows due to the growing demand for consumer electronics products across the globe. These consumer electronics devices require materials to handle high temperature and offer light weight properties. However, the growth of the market slows down due to the availability of cheaper devices that may offer many features like thermoplastics. On the contrary, innovation in thermoplastics resin is anticipated to create future opportunity of the growth of the market.

Additionally, the top players operating in the market include Avient Corporation and BASF SE among others are adopting various business strategies that include product launch to maintain their market presence and expand their product portfolio. Advances in thermoplastic resins, like Elium resin, are opening new possibilities. The liquid resin is durable, recyclable, and can be heat-welded or thermoformed, which makes it a versatile and sustainable choice. Its one-of-a-kind attributes spell out how it is going to bring about a noteworthy revolution specifically in those sectors that are eager for stronger, lighter, and eco-friendly materials.

Rising Demand for Consumer Electronics Drives the Growth of the Market

The rising demand for consumer electronics products across the globe needs top quality materials to handle the heat released by the devices. Thermoplastics offers such features and also makes the product look stylish without compromising the product look and durability. The report released by the UN Trade & Development (UNCTAD) states that the smartphones shipment crosses the figures of around 1.2 billion in 2023 globally. This massive number in smartphone production drives the demand for advanced material to enhance the performance and durability of the product.

Expanding Automotive Sector Fuels Market Growth

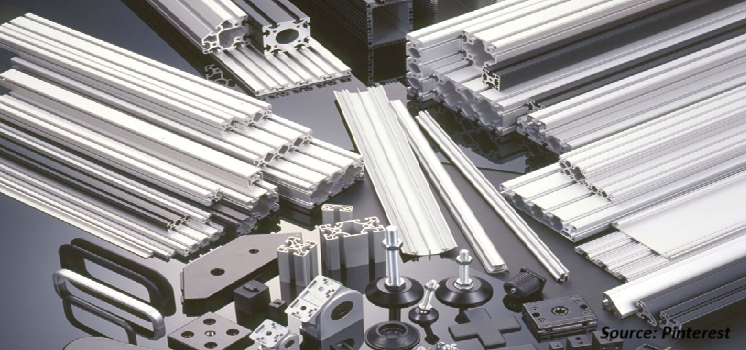

Being a major force for the growth of the market, the automotive industry focuses on cost-effective and environment-friendly vehicle production. These products focus on low emissions along with efficient performance. These products require thermoplastic type materials that composites must manufacture because of their ultra-strength, resistance to high temperature, and lightweight properties.

As reported by the International Organization of Motor Vehicle Manufacturers (OICA), the total production volume from about 40 countries, including China, the U.S., India, and Japan, reached about 93 million in 2023, an increase from 85 million in 2022 or a growth of 9.4%. The global rise in vehicle production requires materials for the manufacture of lightweight vehicles without compromising their other attributes.

Growing Construction Industry Globally Drives Market Growth

Rise in construction activities globally drives the thermoplastic composites market demand for thermoplastic Composites to enhance the lifespan of infrastructure. As urbanization increases and large-scale projects expand, there is a growing need for materials that resist corrosion endure extreme weather, and reduce long-term maintenance costs.

The International Trade Administration documents show China remains at the forefront of world construction markets with estimated new infrastructure spending of USD 4.2 trillion for the 2021-2025 period. Australian building and construction projects worth over USD 162 billion annually constitute a 10% share of national GDP while fuelling construction activities in Australia industry.

Availability the Cheaper Alternatives Hinders Market Growth

The availability of cheaper alternatives, such as thermoset composites and metals, acts as a barrier to the adoption of thermoplastic composites, hindering the growth of the market.

Innovation in Thermoplastic Resin Creates Future Opportunity

Innovation in thermoplastics resins including Elium risen that is liquid thermoplastics is anticipated to create future opportunity for the market. As the only liquid thermoplastic resin processed such as thermosets, it matches their strength while offering thermoformability, heat-weldability, and recyclability. These features make it a sustainable and versatile choice for various industries.

Market Segmentations and Scope of the Study

The thermoplastic composites market report is segmented on the basis of fiber type, resin type, application, and region. On the basis of fiber type, the market is classified into carbon fiber composites, glass fiber composites, natural fiber composites, and others. On the basis of Resin Type, the market is divided into polypropylene (PP), polyamide (PA), polyetheretherketone (PEEK), and others. On the basis of application, the market is characterized into transportation, construction, electrical & electronics, sports & leisure, and others. Regional breakdown and analysis of each of the aforesaid segments includes regions comprising of North America, Europe, Asia-Pacific, and RoW.

Geographical Analysis

The Asia-Pacific region is the major shareholder of the thermoplastic composites industry that is expected to dominate the market in the forecast period due to the expansion of the automotive industry in the region. Automotive manufacturing companies look for lightweight materials to enhance fuel efficiency and driving performance. Fiber reinforced plastics are suitable for body panels not just alongside structural components but also for internal parts in automotive applications. China was, according to the World Population Review, the country that produced the most vehicles with 27 million, followed by Japan with 7.8 million and India with 5.5 million in 2022. The growing automotive industry in this geographical area requires materials to extend vehicle operating life and meet the latest features.

Moreover, growing production of consumer electronics items such as smartphone and laptops drive the demand for thermoplastic composites to enhance durability, reduce weight, and improve heat resistance of such products. These materials are required to manufacture components that includes casings, connectors, and structural parts to meet the need for high-performance and lightweight solutions. Reports from the Asia-Pacific Foundation of Canada demonstrate that China manufactured 1 billion smartphones during 2022. The surge in production of smartphone drives the demand for thermoplastics to manufacture durable and heat-resistant components.

Alternatively, during the forecast period, the North American region anticipates a stable growth in the market owing to the surge in urbanization in the area. Due to the thermoplastic composites market growth of urban areas, the interest in the production of composite materials like the thermoplastic-matrix composites with carbon fibre reinforcement is also growing stronger, thus they are the materials that through smart, green construction, and improved transportation systems, as well as the realization of sustainable infrastructures, are leading the way to this development.

As reported by the World Bank, the urban population in Canada was 32.9 million compared to 31.8 million in 2022, with a growth rate of 3.5% in 2023. The rise in urban population reflects the growing construction in these areas that in turn drives the demand for advanced materials to support the development of modern infrastructure.

Moreover, the rise in investments in military sector drives the growth of the market as defence organizations focus to improve performance of military equipment there is a growing need for lightweight and durable materials to improve mobility and reduce operational costs. The Stockholm International Peace Research Institute reported that the U.S. military expenditure was valued at USD 916 billion in 2023 from USD 877 billion in 2022. The high budget for military expenditure allows them to involve thermoplastics composites to upgrade their product which offers more stability and shock absorption.

Competitive Landscape

Various key players operating in the thermoplastic composites industry are LANXESS, Solvay, BASF SE, Celanese Corporation, SABIC, Avient Corporation, The 3M Company, Mitsubishi Chemical Holdings Corporation, SGL Carbon SE, Toray Industry Inc and others. These companies are adopting various strategies including product launches to remain dominant in the market.

For instance, Avient Corporation brought out new sustainable materials in October 2024, which included thermoplastic elastomers containing recycled content, with variances of up to 60% post-consumer recycled content and metallic pre-colored sulfone compounds in such shades as gold, bronze, and silver. Such innovations attest to Avient's contribution towards sustainability in the plastic industry.

Additionally, in October 2024, BASF SE launched Elastollan which is an ether based thermoplastic polyurethane. The series has an exceptional hydrolysis and microbial resistance and has found its usage in transportation, industrial manufacturing, and footwear.

Moreover, in September 2024, Toray Industries Inc. launched Toray Cetex PESU thermoplastic composite materials. These materials are designed for lightweight and sustainable aerospace applications with superior impact resistance.

Key Benefits

-

The report provides quantitative analysis and estimations of the thermoplastic composites market from 2025 to 2030, which assists in identifying the prevailing market opportunities.

-

The study comprises a deep-dive analysis of the current and future thermoplastic composites market trends to depict prevalent investment pockets in the market.

-

Information related to key drivers, restraints, and opportunities and their impact on the market is provided in the report.

-

Competitive analysis of the players, along with the thermoplastic composites market share is provided in the report.

-

SWOT analysis and Porters Five Forces model is elaborated in the study.

-

Value chain analysis in the market study provides a clear picture of roles of stakeholders.

Thermoplastic Composites Market Key Segments

By Fiber Type

-

Carbon Fiber Composites

-

Glass Fiber Composites

-

Natural Fiber Composites

-

Others

By Resin Type

-

Polypropylene (PP)

-

Polyamide (PA)

-

Polyetheretherketone (PEEK)

-

Others

By End-Use Industry

-

Building & Construction

-

Automotive

-

Aerospace & Defense

-

Energy Generation

-

Insulation & Thermoacoustic

-

Others

By Region

-

North America

-

The U.S.

-

Canada

-

Mexico

-

-

Europe

-

The U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Netherlands

-

Finland

-

Sweden

-

Norway

-

Russia

-

Rest of Europe

-

-

Asia-Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Indonesia

-

Singapore

-

Taiwan

-

Thailand

-

Rest of Asia-Pacific

-

-

RoW

-

Latin America

-

Middle East

-

Africa

-

Key Players

-

LANXESS

-

Solvay

-

BASF SE

-

Celanese Corporation

-

SABIC

-

Avient Corporation

-

The 3M Company

-

Mitsubishi Chemical Holdings Corporation

-

SGL Carbon SE

-

Toray Industry Inc.

-

Syensqo

-

Collins Aerospace

-

Toray Advanced Composites

-

Arkema

-

Ensinger

REPORT SCOPE AND SEGMENTATION:

|

Parameters |

Details |

|

Market Size in 2024 |

USD 30.86 billion |

|

Revenue Forecast in 2030 |

USD 49.29 billion |

|

Growth Rate |

CAGR of 8.1% from 2025 to 2030 |

|

Analysis Period |

2024–2030 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025–2030 |

|

Market Size Estimation |

Billion (USD) |

|

Growth Factors |

|

|

Countries Covered |

28 |

|

Companies Profiled |

15 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent to up to 80 working hours of analysts) after purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

Speak to Our Analyst

Speak to Our Analyst